The future of the wellness market

Dear all,

Last time we shared an article about How Gwyneth Paltrow Turned Goop Into a $250 Million Wellness Obsession.

Do you know how big the global wellness market is? Well, McKinsey has given us an answer: $1.5 trillion, with annual growth of 5 to 10 percent.

In the below report, McKinsey has revealed from their Future of Wellness survey the six categories that interest consumers the most; and six wellness trends that companies can respond to. Read on to get the details!

And check out this week’s featured business slatemilk.com, a better built, more nutritious chocolate milk!

Last but not least, if you would like to engage with founders from our community, whether through money, time, or expertise, please CLICK THE BUTTON BELOW!

Feeling good: The future of the $1.5 trillion wellness market

Our latest research shows that consumers care deeply about wellness—and that their interest is growing. In a survey of roughly 7,500 consumers in six countries, 79 percent of the respondents said they believe that wellness is important, and 42 percent consider it a top priority. In fact, consumers in every market we researched reported a substantial increase in the prioritization of wellness over the past two to three years.

We estimate the global wellness market at more than $1.5 trillion, with annual growth of 5 to 10 percent. A rise in both consumer interest and purchasing power presents tremendous opportunities for companies, particularly as spending on personal wellness rebounds after stagnating or even declining during the COVID-19 crisis. At the same time, the wellness market is getting increasingly crowded, creating the need to be strategic about where and how companies compete.

In this article, we’ll reveal what our survey data tell us about changing consumer attitudes and behavior toward wellness. We’ll couple these insights with the best strategies for companies—both established players and new entrants—to meet consumer needs and preferences in this strong and growing market.

How consumers define wellness

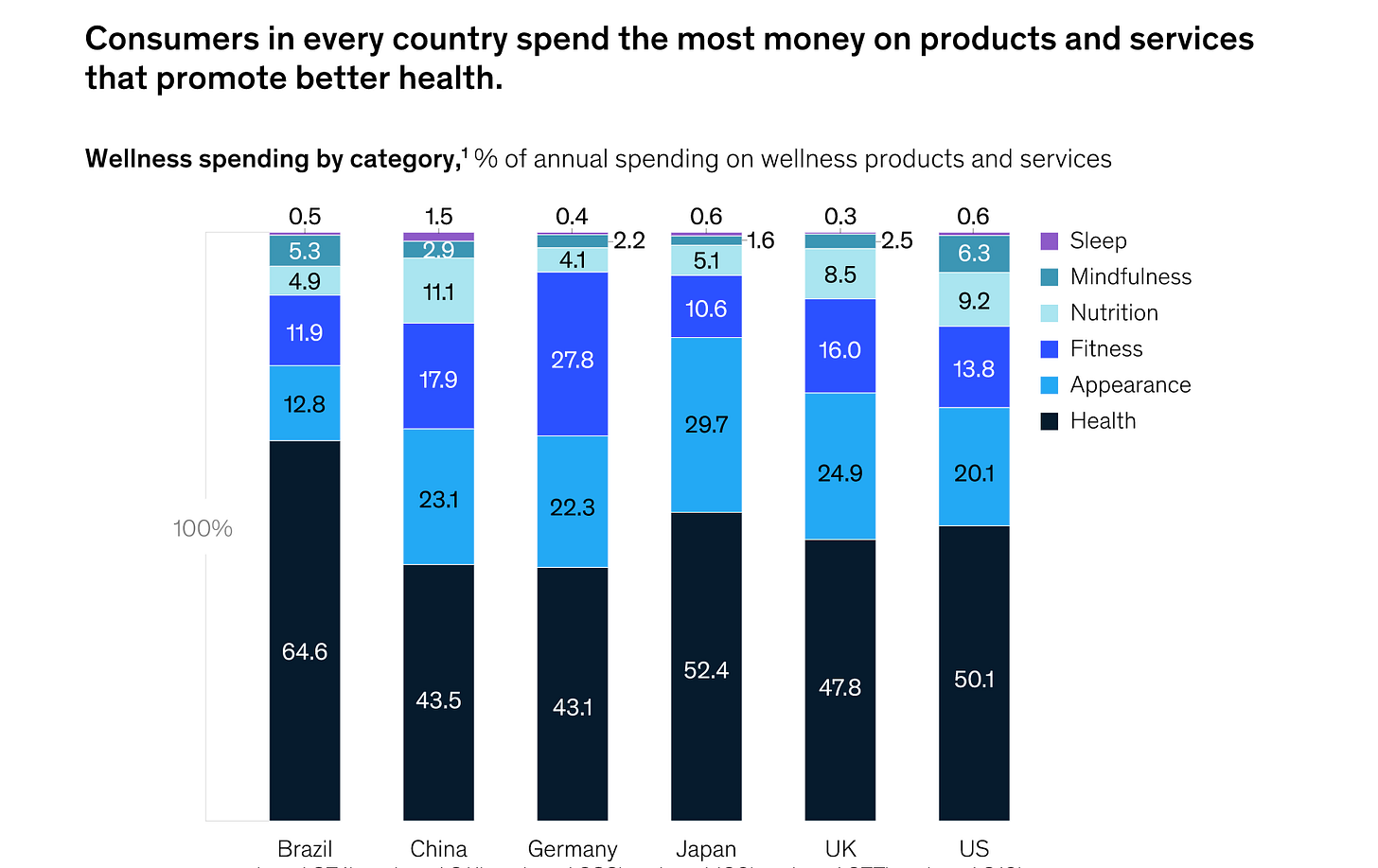

Our Future of Wellness survey revealed the categories that interest consumers most:

Consumer trends and how companies can respond to them

Trend 1: Natural/clean products get their day in the sun

Consumers are keen for natural/clean products in an array of areas, such as skincare, cosmetics, multivitamins, subscription food services, and sleep enhancers. The magnitude of the shift is striking. Consumers overwhelmingly indicate a preference for natural/clean products, particularly in Brazil and China.

In the case of dietary supplements, consumers around the world said, by 41 percent to 21 percent, that if they had to choose between more natural supplements and more effective ones, they would choose the more natural option. Same with skincare: by 36 percent to 21 percent, consumers said they would choose the more natural option over the more effective one.

Potential strategy for companies. Reevaluate your development road map to consider whether you have more opportunities to introduce natural or wellness-oriented products or to acquire natural/clean product lines. This strategy could look different by segment: in apparel, products designed with organic/natural materials and sustainability in mind; in consumer health, natural/clean beauty products; in retail, merchandising with an eye to products that resonate as authentically natural.

Zarbee’s Naturals focused on providing a solution for parents seeking natural remedies for their children; Sephora’s private-label brand has launched clean makeup products4 and has significantly expanded its clean makeup presence in its stores.

Trend 2: More personalization, please

While many respondents told us privacy is still a concern, many (particularly in Brazil and China) are more comfortable trading privacy for personalization. Furthermore, a substantial majority of consumers around the world say they prioritize personalization now more than they did two or three years ago. In the United States, the United Kingdom, and Germany, more than 88 percent of consumers report prioritizing personalization as much as or more than they did two or three years ago.

Potential strategy for companies. Develop personalized marketing capabilities to target the precise consumer segments that may be most interested in your products, with messaging and storytelling tailored to those consumers. Consider introducing personalized or semipersonalized offerings to your product road map.

A wellness start-up, for example, provides personalized vitamin and supplement subscriptions based on information that consumers submit through a quiz. A fitness-tech company created a fitness tracker that collects physiological data to provide personalized sleep and fitness information to users. Membership includes the tracker, access to daily analytics and coaching, and the ability to join online communities.

Trend 3: The future is digital

The shift to digital channels is happening at the speed of “a decade in days.” Our research suggests that the change will be sticky: a majority of consumer categories will continue to project more growth in e-commerce than in other channels over the next several years.

We do see traditional channels holding for certain product categories: fortified foods, multivitamins, and skincare still largely sell through brick-and-mortar stores. Other breakout categories (such as fitness wearables) are almost entirely online native. Consumers in China report the highest share of wellness spending online, followed by those in Japan and trailed by those in Europe, the United States, and Brazil.

Potential strategy for companies. Create seamless omnichannel and digital offerings to ensure that you meet your consumers where they are. Beyond building channel partner relationships, consider developing a supply chain, package sizes, marketing, or the like specifically for e-commerce. For service offerings such as gyms, use a holistic online strategy to build app-enabled features that keep consumers engaged throughout the ecosystem.

For example, one vitamin brand sold only online and known for being sustainable originally offered vitamins for women but has expanded to include products for men and children. Its ecosystem includes the company’s app, which is integrated into Apple Health, as well as an active social-media presence.

Trend 4: Under the influencers

Influencers are a key part of the wellness market, and one that traditional companies have had to learn how to leverage for connecting with consumers. In the United States, Europe, and Japan, 10 to 15 percent of consumers say they follow social-media influencers and that they have already made a purchase based on an influencer’s recommendation. A much higher percentage say they definitely or probably will consider doing so in the future.

In China and Brazil, the percentage of consumers who say that an influencer has driven their purchasing decisions is much higher, at 45 to 55 percent. This trend applies consistently across both large-scale social-media influencers (defined as 100,000 followers or more) and small-scale influencers (less than 100,000 followers). In unwelcome news for celebrities, their influence appears to be waning among most consumers, particularly in the United Kingdom.

Potential strategy for companies. Use influencers to win with your consumers across social channels, partnering with agencies to identify people who will be a natural fit with your brand and resonate authentically with your target consumer base. For instance, one European fitness-apparel company heavily utilizes influencer marketing on Instagram and YouTube to reach its target audience of young fitness enthusiasts.

In 2015, McKinsey data showed that social media influenced 26 percent of purchases across all product categories, a percentage that has increased since then. Our survey shows that wellness is no exception: in every market we researched, more than 60 percent of consumers report that they will “definitely” or “probably” consider a brand or product posted by a favorite influencer.

Trend 5: The rise and rise of services

Services has been a growing part of the wellness market: experiences are increasingly available as offerings. We see this trend reflected across countries—consumers are shifting toward services that address physical- and mental-health needs (for instance, personal trainers, nutritionists, and counseling services). We see services as an enhancement to—not a replacement for—the overall wellness space. Products remain a consistent and critical part of the segment, at roughly 70 percent of self-reported consumer wellness spending globally.

Potential strategy for companies. Consumer healthcare companies could consider diagnostics or coaching offerings that support a direct connection to the consumer. One company partnered with a telemedicine provider to introduce an app that gives parents immediate video access to healthcare providers for their children. Fitness companies could consider offerings such as connected devices and virtual communities—products and services beyond gyms and exercise equipment.

Peloton expanded its service offering to include subscriptions for its fitness app, in-person studios, and live virtual classes, allowing it to reach consumers who may not own Peloton workout equipment. The company’s sales soared in 2020 as the popularity of home workouts increased during the COVID-19 pandemic.

Trend 6: Category lines continue to blur

With the above trends in mind, companies are considering how to play across the health and wellness categories and channels. It’s critical to identify the areas where consumers are open to giving these companies permission to extend their brands.

A majority of consumers report that they don’t want a single solution or brand to help them with all facets of wellness, suggesting that targeted extensions are a more effective approach for companies.

Potential strategy for companies. Assess M&A opportunities to gain entry into more categories within the wellness ecosystem. With this approach, it is important to ensure that any acquisition has a clear strategic rationale and makes sense in view of the acquirer’s existing equity, skill set, and capabilities. If those pieces are in place, we find that a well-defined and executed programmatic M&A strategy can help build resiliency and yield excess returns to shareholders over time.

Lululemon’s acquisition of Mirror, for example, gave it a digital offering to supplement its core fitness-apparel business. It has also experimented with nutrition, mindfulness, and fitness offerings in stores through studios and community-based classes. These moves seem to align with the company’s brand messaging. Meanwhile, other mindfulness and fitness apps have expanded into “sleepcasts” or moved into personalized health coaching and disease management to promote better health outcomes.

McKinsey

Featured business: Slate Milk

Company URL: slatemilk.com

Location: Boston, MA

Founder(s): Manny Lubin, Josh Belinsky

Founded year: 2018

Business is about: Chocolate milk, lactose-free, less sugar, and more protein.

🥛 Tell us about yourself, your company, and how you got started.

Manny and Josh grew up loving chocolate milk, but along the way became lactose intolerant and more health-conscious. So they teamed up to start Slate, a line of lower sugar, higher protein, lactose-free chocolate milk designed for active millennials and healthy-minded adults. They acquired their first batch of customers from Kickstarter.

🥛 Did your business pivot in the pandemic?

We reallocated in-store marketing dollars to digital DTC marketing.

🥛 What is your plan for the future? What trends do you foresee for your industry?

We plan to continue to create more low sugar, high protein offerings. We believe the trend towards 'functional beverage' will only continue to rise. People drink beverages that are either calorie-free or have a functional benefit (ex. protein, caffeine, etc.).

🥛 Any other lessons/advice you’d like to share with other fellow entrepreneurs?

Look at all the data, markets, etc. but in the end, know your gut feeling is often a good one. Your gut is typically your mind subconsciously interpreting all of the info you have seen and pointing you in a direction.

🥛 Any requests for help from our community?

Try some of our milk at slatemilk.com!!

July Drop - Brex Partnership Offering!

🌟 Incubateme is thrilled to partner with Brex to offer several banking and lending products for small businesses! CHECK IT OUT HERE!

Specifically, there are 3 relevant programs:

1. Brex Cash & 1-Day Card:

Brex Cash can be a complete bank account replacement or supplement your current bank. It comes with FREE wires, FREE checks, and FREE ACH payments. The 1-day card is similar to a debit card in that you pay the card off daily, but you earn all the rewards of a credit card!

2. Credit Card with high limits:

Brex underwrites based on either revenue or cash balance in your bank or Brex Cash. Coming in from the Incubateme’s landing page, companies can get underwritten with just $10k in their bank account if they are willing to connect it via Plaid. If you have at least a $10K balance, you will get a $5K limit off the bat and a 20% of cash balance limit once you are at $50,000

3. Amazon Instant Payouts:

This is to get the Amazon instant payment in a day instead of the traditional 14 days! Brex is completely free and does not require a personal guarantee on the accounts! It is also a great way to build business credit.

🥇Stay in touch at www.joinincubateme.com. Follow us on Instagram: @joinincubateme, Twitter: @incubateme, or email us at joinincubateme@gmail.com.